The Uphill Battle to Beat Inflation

The cost of living is outpacing the value of humanity.

The Inflation Story We Were Sold

It’s not your imagination. The price of life has quietly doubled.

Things that once filled a cart or lasted a month now only go halfway. Prices for groceries, clothes, rent, childcare, dinner out. But you wouldn’t know that from how politicians or the media talk about inflation.

The Bureau of Labor Statistics reported that inflation has softened and back to normal. Investors are happy, but if you’re still angry about how much you’re spending at the grocery store, you have every right to be.

What investors don’t seem to care about is that prices are already up 60%, 80%, even 100% over the past decade… and they’re not coming back down.

The Sleight of Hand

Inflation is always reported as a rate of change, and 3% is considered normal. So when politicians and economists and the media report “steady” or “stable” or “normal” inflation, they mean prices are rising at a pace of 3% per year.

We’ve been conditioned into boredom with reports on the economy until more recently when prices rose quickly in a short period of time. But even “normal” inflation is arguably a tough pill to swallow for the average American.

Let’s do the math:

3% compounded over 10 years is 34%. Something that cost $1.00 ten years ago is now $1.34, $100 is now $134. That $750 sofa from IKEA you’ve been saving up for is now over a thousand dollars ($1,005).

And when some years hit 7 or 9%, the real-world increase across a decade easily doubled the cost of essentials.

Imagine there’s a little water in your basement that is rising “only 3% per year.” No one mentions that in a a decade you’ll be wading through the living room.

This is the quiet magic trick of modern economics — a shift in framing.

By focusing on the rate instead of the level, those in power change the conversation from “how much more expensive life has become” to “how well they’re managing the economy.”

Funny Math

The official narrative goes like this:

Inflation was high, but it’s now “under control.”

The system worked — policy adjustments, interest rate hikes, and patience have restored balance.

The economy is strong, unemployment is low, wages are up.

But here’s what those numbers hide:

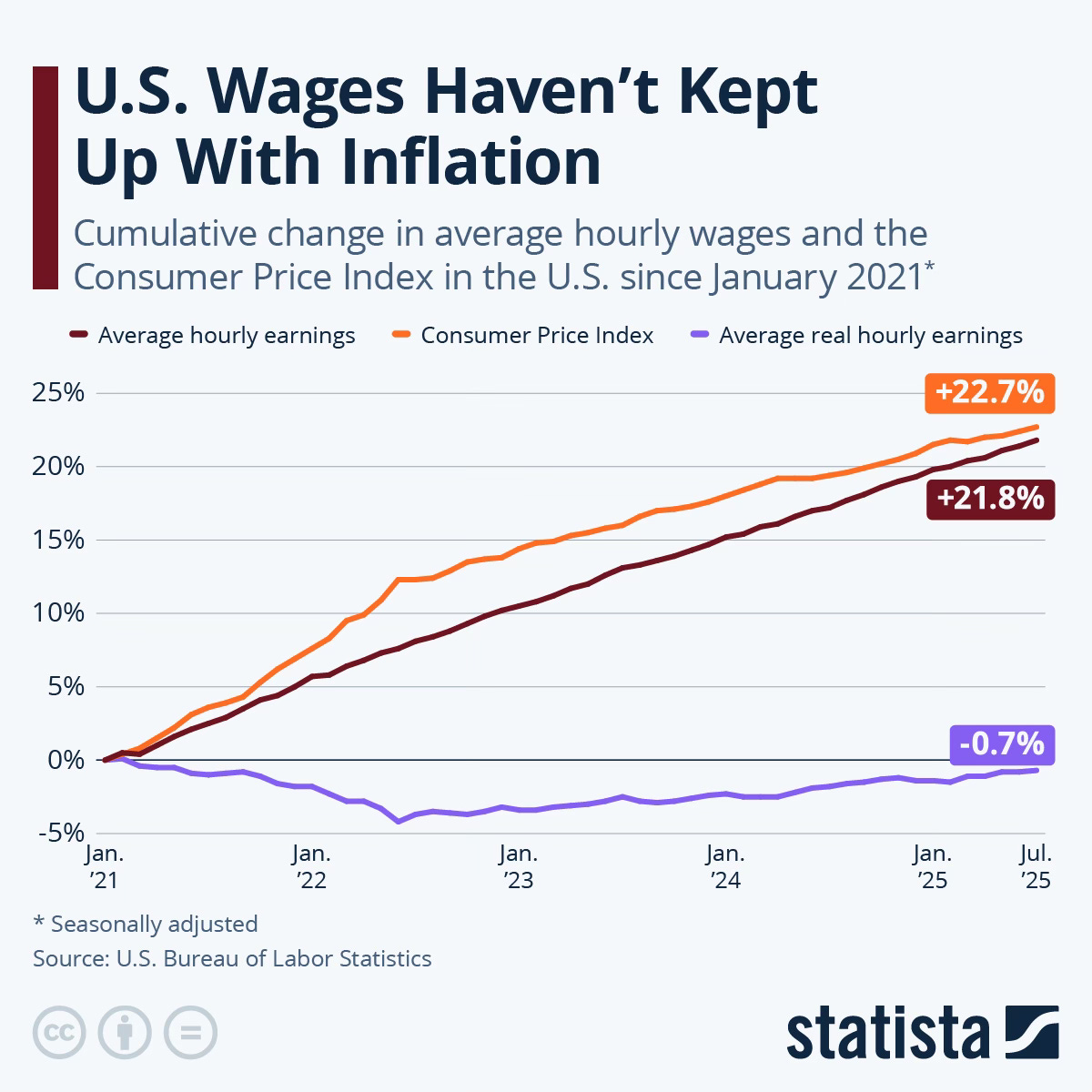

Wages haven’t kept up with cumulative inflation. Real purchasing power for most households is lower than it was in 2014.

The CPI understates daily reality. It’s based on an “average” basket of goods, where cheaper electronics offset soaring food, housing, and healthcare.

Substitution bias assumes that if steak becomes unaffordable, you’ll just eat chicken — so the data shows “stable inflation,” even when your diet has changed out of necessity.

In other words, the people reporting these numbers are ignoring humanity. The story has been engineered to sound reassuring while you quietly recalibrate your life downward.

The Rat Race

Every time you ask for a raise, you’re told to justify it with performance, ambition, or added value as if you’re asking for a reward. No doubt many of us place a lot of self worth into that little bump at the end of the year. But in truth, you’re asking to not fall behind.

If your wage goes up 3% this year, and inflation is also 3%, your purchasing power is flat, negating any “raise” you thought you got. If inflation is worse than normal, say 7%, you’re poorer than you were, no matter what your bank deposit says.

Purchase Power Calculation

$60,000 salary + 3% raise = $61,800

$60,000 + 3% inflation in one year = $61,800. Congratulations, you just broke even.

$60,000 + 7% inflation in one year = $64,200. You’re $2,400 poorer than last year.

$60,000 + 34% inflation over ten years = $80,400. For the love of all things holy I hope you’ve at least been getting a 3% raise.

This is the hidden cost of inflation: you have to outperform it just to tread water. And yet, we’re sold the idea that success is about hard work and personal merit. The reality? Unless your wage growth consistently beats inflation — which historically, it hasn’t for most workers — you’re being quietly eroded.

The American Dream promises upward mobility and the capitalist myth tells us effort is rewarded. When at best wages only rise as much as the cost of living, however, that dream becomes a hamster wheel — always moving, never advancing. But, hey, you deserve a pat on the back.

Real Math

If you step outside the data dashboards, the truth is much simpler:

The cost of being alive has doubled, and the reality is politically unpalatable.

From 2014 to 2024:

Eggs: up 140%

Restaurant meals: up 65%

Rent: up 70–120% in many cities

Used cars: up 80%

Childcare and education: up 50–90%

Clothing: up 40–60% depending on brand (TEMU and the like are unverifiable as the data is out on replacement velocity of factory-to-garbage garments)

These are not temporary spikes. They’re the new normal. The story that inflation is “cooling” only means the rate of increase slowed. But the slope never reversed.

When inflation falls from 9% to 3%, it doesn’t mean prices dropped 6%. It means they’re still 12% higher than two years ago.

The Narrative Gap

Acknowledging the cumulative impact would expose the quiet failure of the U.S. economy and those in power, from local representatives to the very top of the government food chain. It would force uncomfortable questions:

Why hasn’t the median wage doubled alongside the cost of living?

Why do economic “success stories” feel like personal struggles?

Why is stability defined by the absence of crisis rather than the presence of personal security?

The answer, of course, is that the system wasn’t designed for the average consumer to win. It was designed to maintain confidence in markets, in governments, and in the illusion of prosperity.

We need to come together around the reality of every day Americans:

The cost of life has doubled.

Normal is unaffordable.

Wages are permanently behind.

That’s the true story that belongs to the people living it, not those managing the optics of it.

~ Lindsay