Capitalism Cracked in Two. Which Side Are You On?

How the Bifurcation of Capitalism Permanently Tips the Scales Against Every Day Americans

There’s been a shift in the class ethos where we’re all living in the same country but playing by two different sets of rules. (Okay, maybe it’s been that way for a while but we’ve reached the point of no return.)

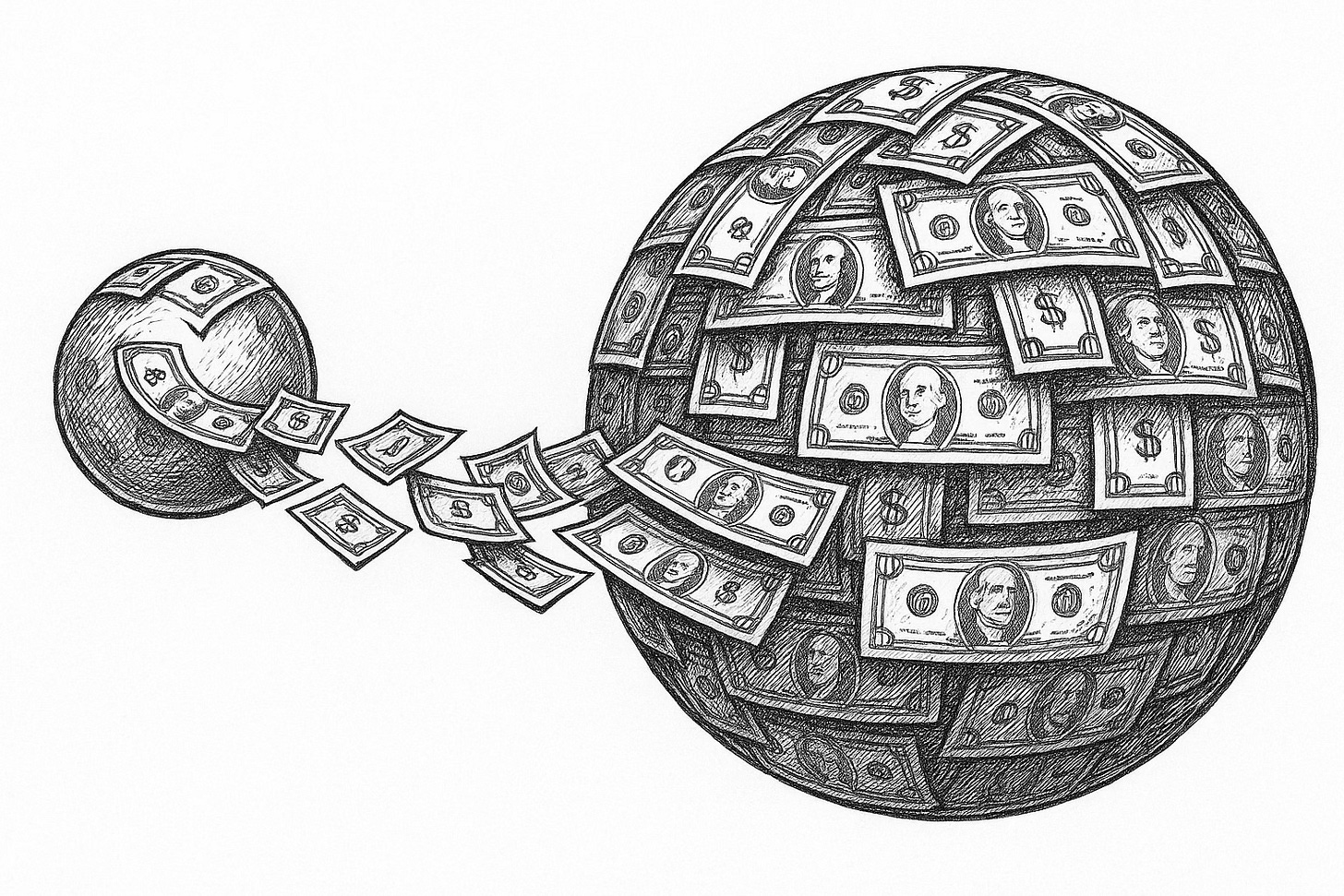

For most of us, the real economy means grocery bills and rent or a mortgage scraped together from our hard-earned paychecks. For billionaires, it’s stocks, leveraged assets, and derivatives — money that multiplies itself without ever touching the real world. The real economy and the paper economy (as coined by economists) are no longer connected in any meaningful way, but have become two different beings. One is alive, sweating through endless toil and survival, while the other, like an undead beast, feeds on it from the shadows.

Economists have a term for this split system: the bifurcation of capitalism. It means capitalism has mutated into two creatures. One side has grown so rich it feeds on the mere promise of more, while the other is trapped in an endless loop of labor and consumption (work, spend, repeat). In simpler terms: there’s the paper economy and the real economy — the parasite and the host. And the lifeblood between them is starting to run thin.

How the Ultra-Rich Exploit the Paper Economy to Get Richer

Money doesn’t follow the same rules in the paper economy as it does in real one the rest of us participate in.

You and I need hard capital (e.g. money in the bank or cash under your floorboards) to buy the things we need or want. Instead, the ultra-rich have promises — stocks, valuations, and collateral like real estate — that banks happily treat as money. Elon Musk doesn’t have a trillion dollars sitting in a vault somewhere; he has leverage — a kind of financial lifeblood that multiplies on its own.

And leverage feeds itself. It buys everything — real things like jets, mansions, and plasma-swapping sessions with a blood boy; and unreal things like influence, access, and ownership in the very companies that drain the working class. The cycle is self-sustaining: wealth attracts more wealth, pulling opportunity, security, and stability out of reach for those bound to the real economy.

If you’re wondering, in 2025 the estimated entrance fee into this paper economy is roughly $10 million. That’s the point at which a person, excluding the financially unsavvy or the misfortunate lottery winner, can borrow endlessly against their assets and never need “money” like the rest of us do. It’s part of a tactic known as “Buy, Borrow, Die.”

The paper economy of the ultra-rich lords above the real one, extracting its value while returning little back to the people who sustain it. With each cycle of leverage feeding leverage, the real economy is left to slowly bleed out.

Food: Survival as a Commodity

Nothing exposes the split between the two economies like food.

Food is part of how we survive, and survival has gotten expensive. “Eggs” has become a trigger word.

For the billionaire class, food isn’t nourishment — it’s leverage. The higher prices climb, the better their balance sheets look. And while profits rise for the ultra-rich, the food itself deteriorates. We’ve been weaned onto ultra-processed products so nutritionally void they hardly count as food, engineered to short-circuit the brain’s sense of fullness so we keep eating and spending past reason.

Furthermore, it should be astonishing in the eye of history that we don’t grow our own food anymore. This NSFW TikTok sums it up:

We are shackled to a sprawling, fragile supply chain designed for profit, not resilience. When it breaks (e.g. pandemic, war, drought, tariffs, uncontrolled inflation) children go hungry, while the ultra-rich suckle Dubai chocolate from their mega yachts.

Housing: Shelter as a Speculative Instrument

Home was once a metaphor for stability, but for most people it has become some out-of-reach ideal found only in fairytales. In the paper economy, hedge funds, a favorite leveraging tool, have quietly bought up neighborhoods, turning homes into income streams. Meanwhile, the average person in the real economy just wants a place to live that doesn’t consume half their paycheck.

More homes are now “holdings” than safe havens. Most people don’t own where they live anymore, they rent it from the paper economy.

Healthcare: Survival as a Subscription

In the real economy, getting sick begets financial gymnastics. A broken bone, a bad diagnosis, even a prescription refill can set off a chain of debt. People ration insulin, skip checkups (me), delay care until pain becomes crisis (me in five years) because it’s easy to imagine the bill might be worse than the illness.

And yet, the United States remains the only wealthy, industrialized nation on Earth without universal healthcare. Every other developed country figured out that keeping people healthy is cheaper and more humane than monetizing their suffering.

Meanwhile, in the paper economy, healthcare is an investment vertical.

Private equity firms buy up hospitals, insurers, and nursing homes. They pour money into “health data platforms” and “care optimization algorithms” not to heal, but to harvest. Because sickness pays dividends, and every patient becomes a data point in someone else’s quarterly report.

The cruelest irony is the people who do the most to keep others alive — nurses, aides, EMTs, janitors, pharmacists — are the ones most likely to struggle paying for their own healthcare. The system exploits their labor while denying them its benefits.

Keeping each other alive and well should be the one domain that binds us together. Instead, it’s the clearest proof that capitalism has split in two, with one side bleeding out our most vulnerable, and the other crowd-funding cancer care.

Productivity Without Prosperity (Real Economy)

We’re told the economy is “strong” because unemployment is low and productivity is high.

But the everyday worker knows the math doesn’t add up. Wages haven’t kept pace with inflation (of which “normal” is considered 3% per year, so your yearly 3% bump was never technically a raise), and job security has been replaced by side hustles (that’s fancy for second job), burnout, and an endless stream of subscription bills that you only remember to cancel after the charge hits your credit card.

It seems we’re all working harder than ever, yet somehow, getting ahead is even further out of reach.

Profit Without Production (Paper Economy)

What’s not often talked about is the great economic shift that coincided with our entrance into the digital age. Before the .com boom, the U.S. economy placed its highest value on tangible production — things you could see, touch, and use. Fortunes were built on inventions that changed how we lived: steel, electricity, railroads, automobiles, microchips.

The Rise of Virtual Value

Around the late 1990s, something profound happened. The rise of the internet created an entirely new sector of “work” — digital infrastructure, advertising, data, and platforms. Suddenly, the most valuable products weren’t products at all; they were interfaces and information.

The .com boom (1995–2000) marked the moment when the economy shifted from industrial to virtual. Between 1998 and 2000, tech company valuations skyrocketed on speculation alone — businesses with no profit and sometimes no product were being traded like gold. When the .com bubble burst in March 2000, over $5 trillion in market value evaporated within two years. Yet the logic of that era (growth over grounding, valuation over value) stayed alive and continues to this day.

Tech billionaires earn billions not from creating new industries, but from monopolizing your attention through ads and algorithms.

Real estate and private equity titans profit not from building homes, but from charging rent on ones that already exist.

Finance billionaires make money by moving money faster, not by producing a single tangible thing.

It’s capitalism without craftsmanship, innovation without invention.

Ultra-wealth doesn’t flow from productivity anymore; it exploits it, extracts from it, and hollows out the workers, teachers, nurses, and caregivers who actually hold society together. Meanwhile, we’ve all become the products ourselves — our data packaged and sold to the highest bidder to manipulate what we buy, watch, and even believe.

And because capital chases the highest return, not the greatest need, investment has drifted away from progress. Instead of curing disease, we optimize engagement. Instead of reducing hunger, we hide fees in the grocery aisle. Instead of investing in public good, we engineer new ways sell the illusion of it.

This is what the bifurcation of capitalism really looks like in motion: The real economy withers, while the paper economy burgeons.

It’s Your Fault

You can’t afford a house because didn’t work hard enough.

You could afford your medical bills if you only budgeted better.

This is the narrative we’ve been fed. The bifurcation of capitalism isn’t just economic, it’s psychological. It teaches us to internalize systemic failure as personal inadequacy. Can’t save for retirement? That’s on you, because the board traded your real pension dollars for the CEO’s paper wealth (a sleight of hand known as the stock buyback).

The paper economy, driven by the greed of its billionaire class, thrives on dividing us. They go to great lengths to convince everyday Americans that their struggle is their own fault, while quietly draining them of opportunity and dignity.

That’s the definition of gaslighting and it’s a grotesque mechanism of control.

Reclaiming an Economy for All Americans

If ultra-wealth is bleeding us out, then the only cure is to remember what makes us human.

Grow a little food in your backyard and share it with a friend. Fix something for your family instead of replacing it. Volunteer in your community. Make art that stirs emotion instead of chasing profit. These small, tangible acts of connection resuscitate our humanity. Our motive shifts from “What’s in it for me?” to “What’s in it for us?”

Capitalism’s bifurcation can’t last forever. Either the working class is drained to the last drop, or we come together to change our fate.