Trickle-Down Tyranny: Why the Rich Keep Winning The Tax Game

Eliminating tax cuts for the top 5% would protect SNAP, Medicaid, and Medicare.

The House just passed what it proudly calls the “One Big Beautiful Bill.” That name might sound like it came from a used car commercial—and in some ways, it did. Because, while it sells a promise of prosperity, what it actually delivers is a massive transfer of wealth: from working families to the top 5% of Americans.

In spite of repeated failures, including ballooning deficits, rising inequality, and lackluster job growth following major tax cuts in 1981, 2001, and 2017, Republicans are again pursuing a budget which favors the rich without saying so outright. It is disingenuous and offensive because they know the truth. There is an old saying:

“Insanity is doing the same thing over and over again and expecting different results.”

At the center of the bill is a staggering figure:

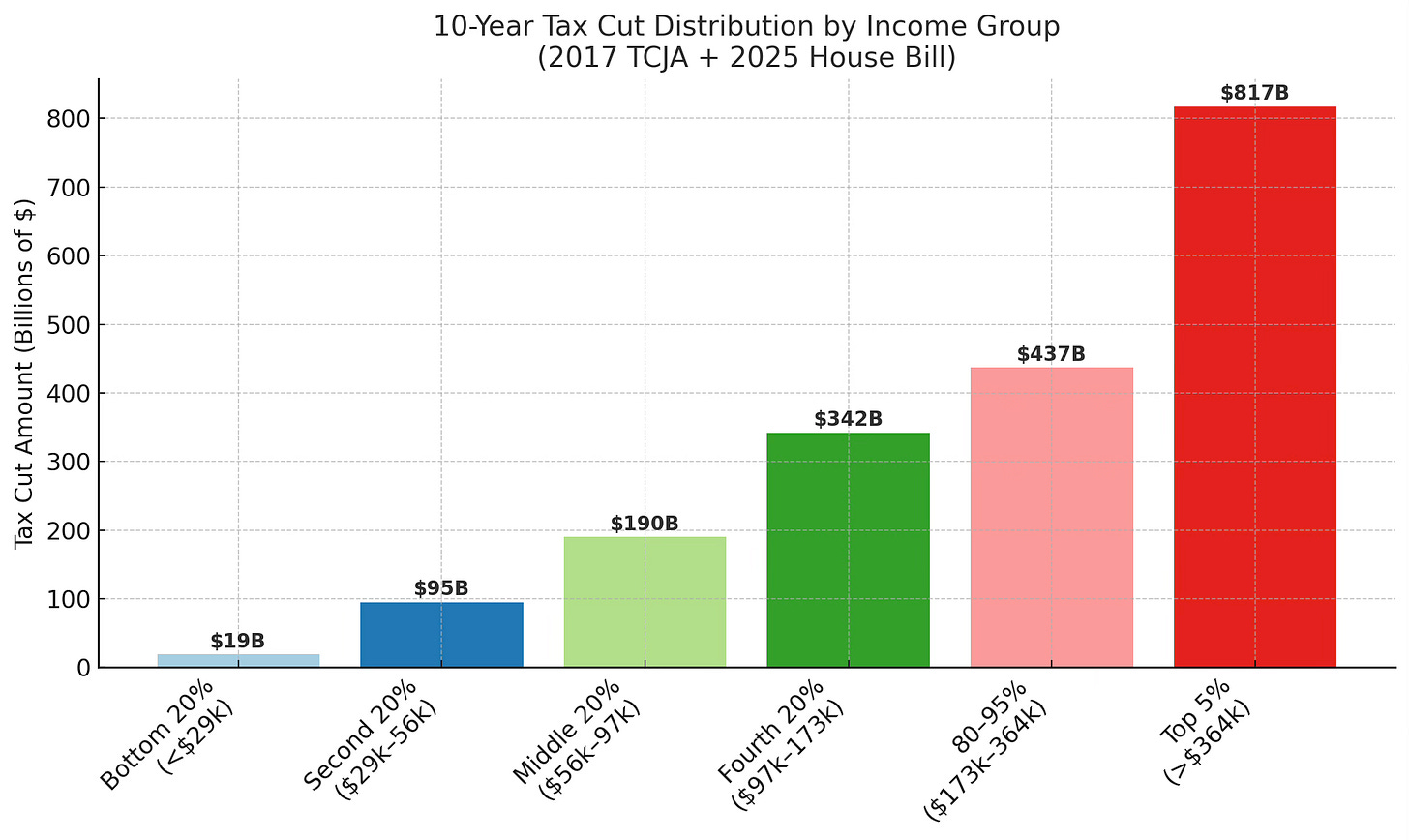

👉 $817 billion in income tax cuts going to the wealthiest 5% over the next ten years.

To pay for that gift, Republicans have proposed deep and devastating cuts to the safety net that millions of Americans rely on.

None of this is necessary.

If lawmakers simply dropped the tax cuts for the ultra wealthy, no cuts to SNAP, Medicaid, or Medicare would be needed at all!

To fund these tax cuts, the bill includes harsh reductions in essential programs:

$230 billion is being cut from SNAP

Up to 10 million people could lose Medicaid due to new work requirements and red tape

Cuts to Medicare are projected to exceed $500 billion under PAYGO rules

$230 billion is being cut from SNAP - the Supplemental Nutrition Assistance Program that feeds more than 40 million Americans

🧮 Who Really Benefits?

Despite the messaging about 'helping working families,' the numbers tell a different story. The wealthiest 5% of Americans—those earning over $364,000—take home 43% of all tax cut dollars under this plan.

🤔 Why Justify the Unjustifiable?

Republicans claim these tax cuts are necessary to stimulate the economy. They lean heavily on supply-side economic theory—aka Trickle-Down Economics—the notion that cutting taxes for the wealthy will lead to job creation and broader prosperity.

But, the claim seems to be a deliberate scam on the American people, as there’s a mountain of evidence showing otherwise:

The 2017 Trump tax cuts delivered windfalls to the wealthy, but GDP growth remained average, and corporate stock buybacks surged instead of wage increases.

Kansas’ failed tax-cut experiment tanked the state’s budget. It was so terrible that it was reversed by the Republican legislature.

SNAP produces $1.50 in GDP for every $1 spent - making it one of the most effective economic stimulants.

So what are the true motives behind their giveaway to the 5% wealthiest?

Their political survival is tied to donors and corporate interests

They want to weaken the social safety net by limiting government revenue

They are executing a long-term goal of plutocratic order (Project 2025) under the guise of “freedom” and “efficiency.”

This isn’t about economic growth. It’s about political priorities. And right now, those priorities are tilted toward donors, not voters.

📣 A Different Choice Is Possible

We’re told we have to choose between feeding children and letting billionaires keep their tax breaks.

That is a false choice.

Eliminating the $817 billion tax cut for the top 5%—just that one policy—would protect SNAP, Medicaid, and Medicare from these brutal reductions.

Tax cuts for the rich aren’t a growth strategy. They’re a payout, and Republicans know it!

💥 What You Can Do

• 🖊️ Write to your Senator.

• 📣 Share this with friends who think “tax cuts” are always good.

• 🧠 Challenge the lie that “trickle-down” economics has ever worked for working people.

Let’s call this bill what it is: “One Big Beautiful Lie.”

📖 Sources

ITEP – Analysis of Tax Provisions

Wall Street Journal – GOP SNAP Cuts

Washington Post – Medicare Cuts

Center for American Progress – Failure of Supply-Side Economics

CBPP – Kansas Tax Cut Failure

USDA ERS – SNAP Economic Impact