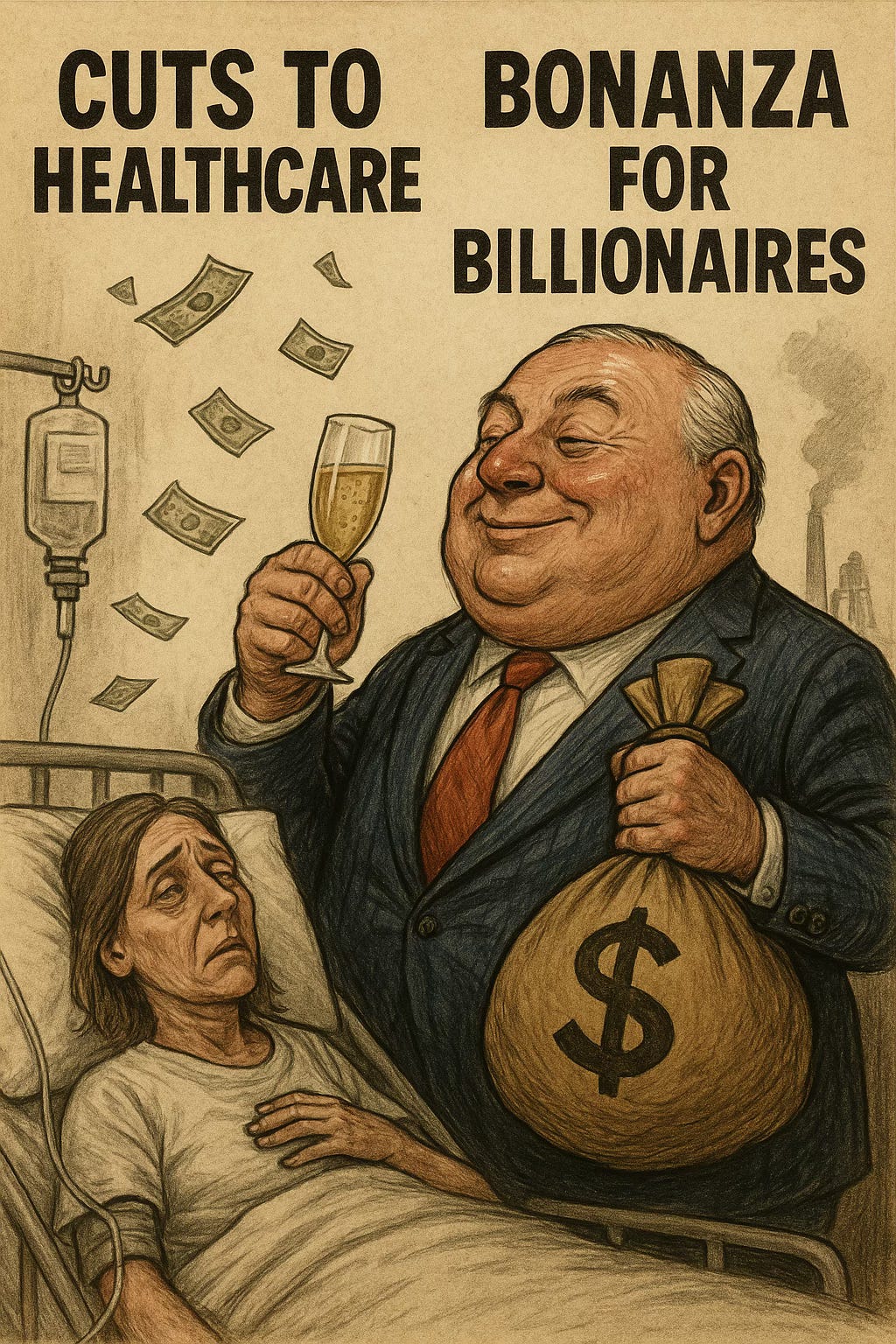

Trump’s Budget Betrayal: Health Cuts, Hunger—and Billions for Billionaires

The Senate just passed a budget that sacrifices healthcare and food assistance for tax giveaways to the ultra-wealthy. It’s not about deficits—it’s about domination.

The Senate just passed the Senate version of Trump’s budget bill. J.D. Vance cast the tie-break vote that will strips healthcare and SNAP benefits from millions of families while funding a bonanza for the ultra wealthy.

Republicans are choosing billionaires over the American people—many of whom believed Trump when he campaigned on making their groceries and rent cheaper. They believed him when he said he would never cut Medicaid. They believed him when he said he would wipe out the budget deficit.

Now, at Trump’s order, Republicans seem determined to make the biggest cut to health care in history—to fund tax cuts to the rich!

There are several reasons Republicans in the Senate and House are doggedly pursuing a bill that will hurt millions of American families and the communities in which they reside.

Trump and Congressional Republicans are answering to ultra-wealthy donors, especially in fossil fuel and technology industries.

Republicans are afraid that, if they go against his wishes, Trump will sabotage their reelection bids—or even incite his most radical supporters to threaten their families..

Project 2025 is replacing, not just the Constitution, but democracy itself—with a unitary executive plutocracy that rewards white, wealthy males.

As I stated in my June 4 Substack, Insanity Is Doing the Same Thing Again and Again… and Again, Republicans cannot seem to quit the bogus”trickle-down” economic theory that has repeatedly exploded the deficit with tax cuts for the wealthy and unchecked military spending.

A historical review of U.S. fiscal policy by party shows a clear pattern:

Republican presidents repeatedly explode the deficit with tax cuts for the wealthy and unchecked military spending.

Emboldened by Project 2025, Republicans are united in their plutocratic agenda—and they’re lying again.

They’re lying when they say this budget doesn’t cut Medicare or Medicaid.

They’re lying (and they know it) when they claim tax cuts for the wealthy will “trickle down” to help the rest of us.”

“The definition of insanity is doing the same thing over and over and expecting different results.”

Here is a look at some of the specific cuts that will drastically impact families and their communities:

Healthcare Cuts

Medicaid Work Requirements

Imposes a 20-hour weekly work requirement for Medicaid recipients with children over 10. Those unable to meet the mandate — especially single parents — risk losing coverage.

Impact: Up to 3.7 million people may lose Medicaid.

Loss of ACA Premium Subsidies

Enhanced subsidies under the ACA will expire at the end of 2025, causing premiums to spike for millions of low- and middle-income enrollees.

Impact: About 13 million enrollees face higher premiums or drop coverage.

Rural Hospital Closures

Medicaid cuts would slash reimbursements that rural hospitals rely on, potentially forcing dozens to close.

Impact: 55 rural hospitals are at risk of closing, which also means thousand of layoffs. In many areas of the country, the hospital is the primary employer.

Combined healthcare provisions could lead to the largest loss of insurance coverage since the ACA repeal attempt.

Impact: Up to 16 million Americans projected to lose health insurance.

SNAP Cuts (Food Assistance)

Work Requirements for Single Parents

Single parents with children over age 10 must now meet a 20-hour weekly work requirement to maintain SNAP eligibility—even without reliable child care.

Impact: Over 1 million single parents may lose benefits.

Cuts to Elderly and Disabled Recipients

Tighter eligibility, paperwork burdens, and verification hurdles will disqualify many low-income seniors and disabled individuals.

Impact: Around 1.8 million people face food insecurity or benefit loss. Nursing homes will face staff shortages and many will close.

Giveaways to the Ultra-Wealthy

A $15 Billion Tax break for corporations

A suite of tax incentives and deductions for corporations total more than $700 billion.

Making the 20% business income deductions permanent will cost another $737 billion.

The bill allows full retroactive R&D expensing from 2022–2024, giving corporations such as Mark Zuckerberg’s Meta an estimated $15.1 billion tax reduction.

Impact: A single corporation saves $15.1 billion — more than the Medicaid shortfall for all rural hospitals combined.

Estate Tax Shelter Expansion

The bill raises the exemption cap and reopens loopholes allowing multi-million-dollar estates to be passed on tax-free.

The change benefits only the wealthiest 0.01% of Americans, as 99.9% are already exempt under current law.

Impact: Thousands of ultra-wealthy families benefit — costing the Treasury an estimated $212 billion annually.

Top 5% Tax Cut Share

Roughly 45% of all tax cuts in the bill go to the wealthiest 5% of Americans. Meanwhile, the bottom 80% receive less than 15%.

Impact: About 8.3 million wealthy individuals receive the lion’s share of benefits.

Fossil Fuel Windfalls & Clean Energy Gutting

(Trump publicly champions fossil fuels. The industry backed him with nearly a half-billion dollars—a direct investment yielding regulatory reversals and policy windfalls. In a Fox News interview, Trump said, “We’re going with coal.” I don’t want windmills destroying our place,” he said. “I don’t want, you know, these solar things where they go for miles and they cover up a half a mountain that are ugly as hell, and by the way the panels are all made, and the windmills, they’re all made in China.”)

Expanded subsidies and Tax Shelters for Fossil Fuels

The bill adds billions in new tax breaks and depreciation perks for oil and gas companies, wile accelerating permitting for drilling, pipelines, and exports—even on public lands.

Impact: Fossil fuel corporations stand to Ian an estimated $125 billion over the next decade, further entrenching carbon dependency and polluting America’s water, land, and air.

Meanwhile, the black lung screening program for miners has been shut down, ending access to early detection services in mining regions. Over 20,000 miners are directly affected

Clean Energy Program Cuts and Rollbacks

The Department of Energy’s renewable programs face a 70% cut, while clean manufacturing tax credits and community solar grants are eliminated.

Impact: Over $300 billion in clean energy support is slashed or reversed, jeopardizing thousands of projects and jobs in solar, wind, EVs, and battery tech.

Inflation Reduction Act Clawbacks

The bill repeals most of the climate and energy provisions in the Inflation Reduction Act—including production tax credits, loan guarantees, and rural transition programs.

Impact: U.S. climate policy is set back at least a decade, and global climate goals face severe setbacks as emissions rise.

This budget is not just cruel—it’s catastrophic. It strips healthcare from millions, kicks food out of the mouths of children and seniors, hands billions to billionaires and polluters, and slashes our investment in a livable future. It rewards greed while punishing vulnerability.

Now, the bill heads to the House of Representatives. This is our last chance to stop it.

Call the House switchboard: 202-224-3121

Email your representative: https://www.house.gov/representatives/find-your-representative

Tell them you oppose this budget. Tell them to vote NO on cuts to healthcare, SNAP, and clean energy. Remind them they work for you—not the billionaires

You say it's about domination, but what I don't get is why they want to take us back to the Middle Ages where we all become serfs and work for the lord of the castle. Why do they want so many poverty-stricken people? I get that it's about domination but it still doesn't make sense to me.