The Art of the Self-Deal

From Tariffs to Crypto, Trump's Policies Funnel Wealth to Himself and His Donors

On Friday, the Bureau of Labor and Statistics reported a downward revision of the job numbers for May and June.1 Because Trump does not want the American public to know that his economic projections are inaccurate, he publicly declared the report “rigged” and fired BLS Commissioner Erika McEntarfer, citing both the weak hiring number for July and the massive downward revisions to prior months’ figures. 2 That does not create confidence in any data coming from the government moving forward. His MAGA cult will believe only his appointed loyalists and the rest of us will distrust anything that Trump approves.

Let’s be clear: the BLS has always revised data—that’s how responsible agencies operate. It’s been doing this work since 1884, with over 140 years of service under its belt. So who do you trust? A professional, nonpartisan agency—or a shady president who screams “It’s rigged!” anytime the numbers don’t flatter him?

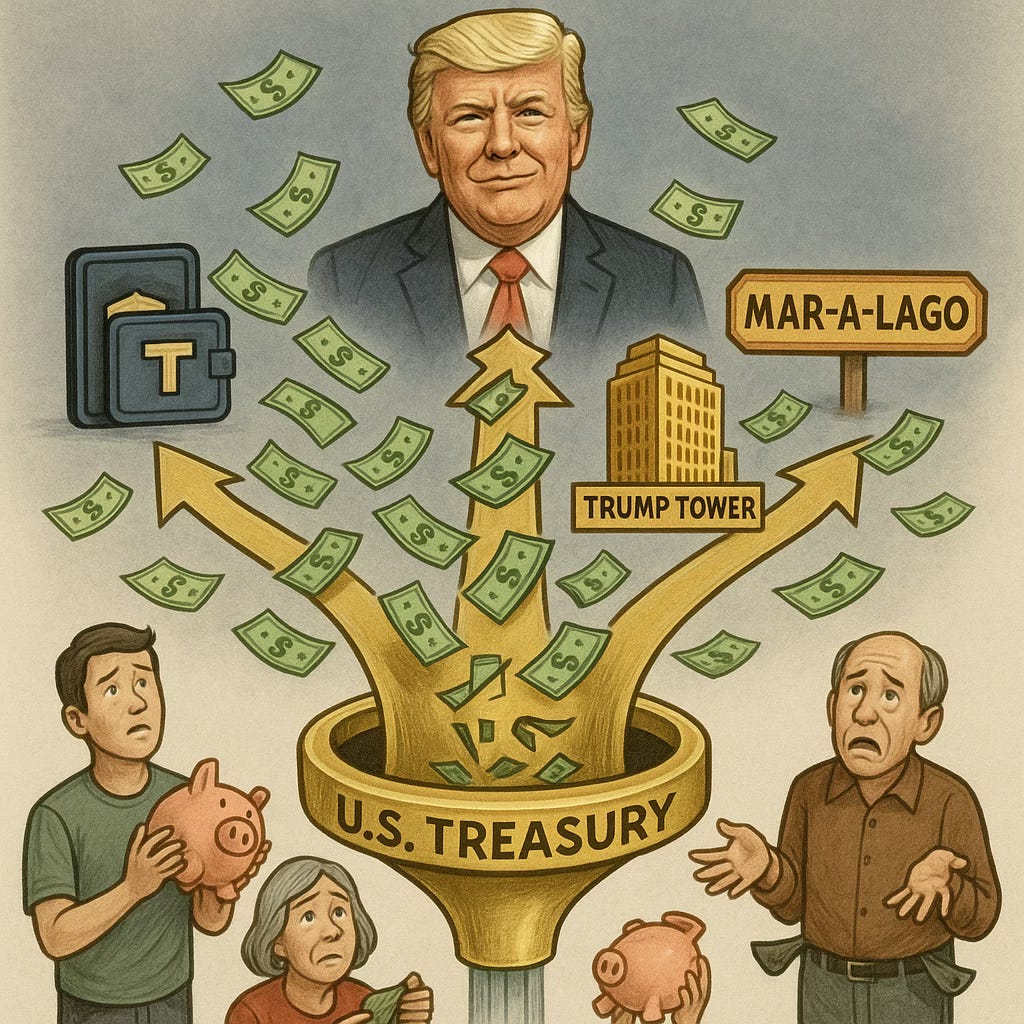

I didn’t take an economics class in college, but I don’t trust the man with a history of multiple bankruptcies and shady dealings with Russian autocrats. His current corrupt self-dealing in cryptocurrency, hotels, golf resorts, and cheap branded goods tchotchkes indicate that his primary interest is his own finances - and those of his billionaire backers. Furthermore, the economic policies he has pursued not only contradict his campaign promises but cause renowned economists to shake their heads. We only have to look at the One Big Beautiful Bill and his personal business dealings (including blatant emoluments clause violations) in his first six months in office to understand his priorities and his limited interest in making sound economic choices for America.

Even without a background in economics, it’s clear that the tariff roll-out was an embarrassing display of disorganization and ignorance - from the ridiculous list of countries and uninhabited islands to the nonsensical tariff percentages. He believes he can bully the world into bending to his will. Manipulation, extortion, bullying, and litigation have long been his “art of the deal.” His rhetoric and economic policies only make sense when you consider how they benefit Donald J. Trump personally. The reality is that his cognitive limitations and severely malignant narcissism prevent him from making sound economic decisions, much less serving as a global leader.

Why is he so intent on lowering interest rates that he badgers and insults the Federal Reserve Chair? Why has he said that he likes a weaker dollar? Why is he obsessed with imposing tariffs? All of his actions point to a single purpose: increasing personal wealth for Trump and his billionaire friends.

When the Federal Reserve lowers interest rates, it weakens the dollar, which helps wealthy Americans and corporations - but hurts everyone else. Trump and his allies may have an incentive to weaken the dollar (though pressure on the Fed or by imposing tariffs that create global uncertainty) because it helps the Trump Organization’s bottom line.

Trump doesn’t need to shout that the dollar is falling. His actions push the dollar downward, and his surrogates do the fear-mongering. That encourages people to. move their money into gold, crypto ordeal estate - assets Trump and his backers hold or profit from.

It’s not always overt, but the feedback loop works like this: Trump pressures the Fed, adds tariffs, and racks up budget deficits. These actions signal potential trouble for the dollar. His allies say, “Protect yourselves - buy crypto/gold/real estate.” Prices of those assets go up. Trump and friends who hold those assets profit quietly.

Trump businesses benefit from a weak dollar:

Trump’s luxury real estate: Trump’s properties (like Trump Tower, 40 Wall Street, or Trump International Hotel & Tower Chicago) becomes cheaper for foreign buyers when the dollar weakens.

Foreign investors—including wealthy Russians, Chinese, and Middle Eastern nationals—have historically been significant buyers and tenants in Trump-branded properties.

Example: If the euro strengthens and the dollar weakens, a €10 million investment can buy more U.S. real estate, boosting demand for high-end condos or commercial leases.

International tourism: A weak dollar makes the U.S. a more affordable destination. Trump’s hotels and resorts benefit from foreign bookings.

Trump’s hotels (e.g. in Las Vegas, D.C., Chicago, and Miami) and golf resorts benefit from increased bookings, particularly among wealthy foreign guests. Events, weddings, and golf tournaments held at these venues become cheaper to book with foreign currencies.

Foreign licensing: Trump licenses his name internationally. A weaker dollar means those fees are worth more when converted.

Example: $1 million paid in euros is worth more U.S. dollars when the dollar is weak compared to the euro.

Branded goods exports: Trump-branded merchandise becomes cheaper for foreign buyers when the dollar is weak.

Cryptocurrency: Trump and his allies promote crypto as a hedge against dollar decline. They hype the fear, people shift their money, and Trump profits..

Trump has shamelessly promoted his crypto while in office - even hosting top investors in his meme coin at the White House. Forbes and other reputable sources estimate that President Trump has generated up to $1 billion in crypto-related income since the start of his second term. 3 In a glaring conflict of interest, he has legitimized and nationalized cryptocurrency through legislation and executive orders:

In March 2025, Trump established a Strategic Bitcoin Reserve and Digital Asset Stockpile, officially making Bitcoin and other tokens a U.S. reserve asset..

On July 18, 2025, Trump signed the GENIUS Act, creating the first comprehensive U.S. legislative framework for stablecoins. 4

His administration dismantled the DOJ’s national crypto enforcement team and dropped major lawsuits against allied firms.

Tariffs:

Trump is stubbornly clinging to the belief that tariffs will create prosperity and offset the massive tax cuts in his One Big Beautifull Bill. His administration is proudly reporting $152 billion collected on imports so far this year. But, they aren’t admitting that tariffs are an added tax - one that disproportionally hurts working Americans. Businesses pass those costs on to their customers, and the wealthy can easily absorb them. Lower-income families cannot.

According to the Yale Budget Lab, all tariffs imposed in 2025 will cost the average household about $3,800/year in lost purchasing power. 5Trump and his billionaire friends won’t feel it. But, for everyday American, it’s a gut punch.

Tariff vs. Tax Break:

Lower-income (< $50K): Tax cut ≈ $200/year; Tariff cost ≈ $1,300/year

Middle-income $60K–$90K):mTax cut ≈ $1,200/year; Tariff cost ≈ $3,000/year

Upper-middle-income ($90K–$200K): Tax cut ≈ $3,500/year; Tariff cost ≈ $3,800/year

High-income (>$200K+): Tax cut ≈ $50,000+/year; Tariff cost ≈ $5,000/year

What Trump sells as “America First” is really a tax on working families. He’s redistributing money from the bottom up - giving giant tax cuts to millionaires and billionaires, then quietly clawing some of it back through tariffs on everyday goods. The net result? Regular Americans end up paying more, while Trump and his wealthy donors come out ahead. This isn’t economic policy - it’s a shell game.

Trump’s self-dealing is unmatched in American history. A Trump family entity holds $22.5 billion of the $WLF tokens –- and takes 75% of net revenue from future token purchases. His businesses have earned hundreds of millions since he returned to office through high-margin ventures like crypto, licensing, and luxury branding. 6

Some of that income appears to come from foreign entities or foreign government–linked sources, 7 raising red flags under the Constitution’s Emoluments Clauses. 8Trump didn't divest. He didn't get Congressional consent He just cashed in!

Trump’s economic agenda isn’t designed to grow the middle class or strengthen the country. It’s designed to benefit Trump. His personal wealth has exploded through crypto, licensing, and foreign investments while he shreds constitutional norms and silences dissent - because the only version of reality he will accept is the one where he always wins But we can’t afford to keep. playing his rigged game. The stakes are too high; for our economy, for our democracy, and for our future.

Footnotes: